Blow for Reeves as Bank halves growth forecast

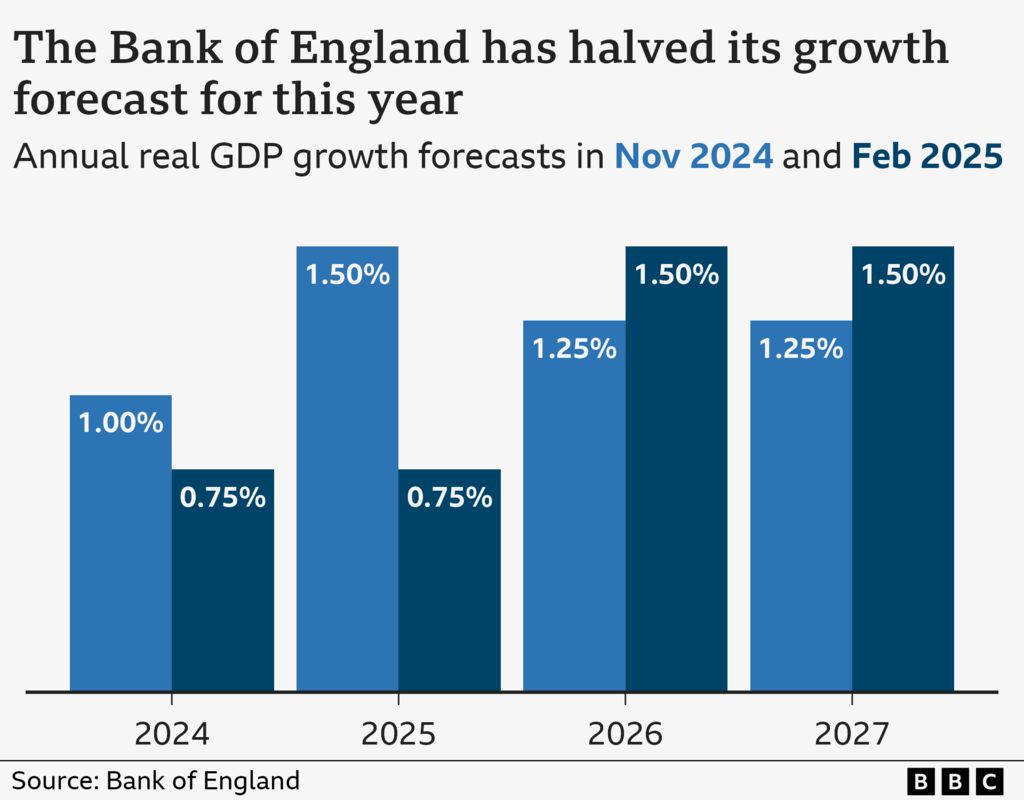

The Bank of England has halved its growth forecast for this year in a blow to the government.

The economy is now expected to grow by 0.75% this year, the Bank said, down from its previous estimate of 1.5%.

The government has made growing the economy one of its key policies and last week the chancellor announced a number of measures to try to boost the UK’s performance.

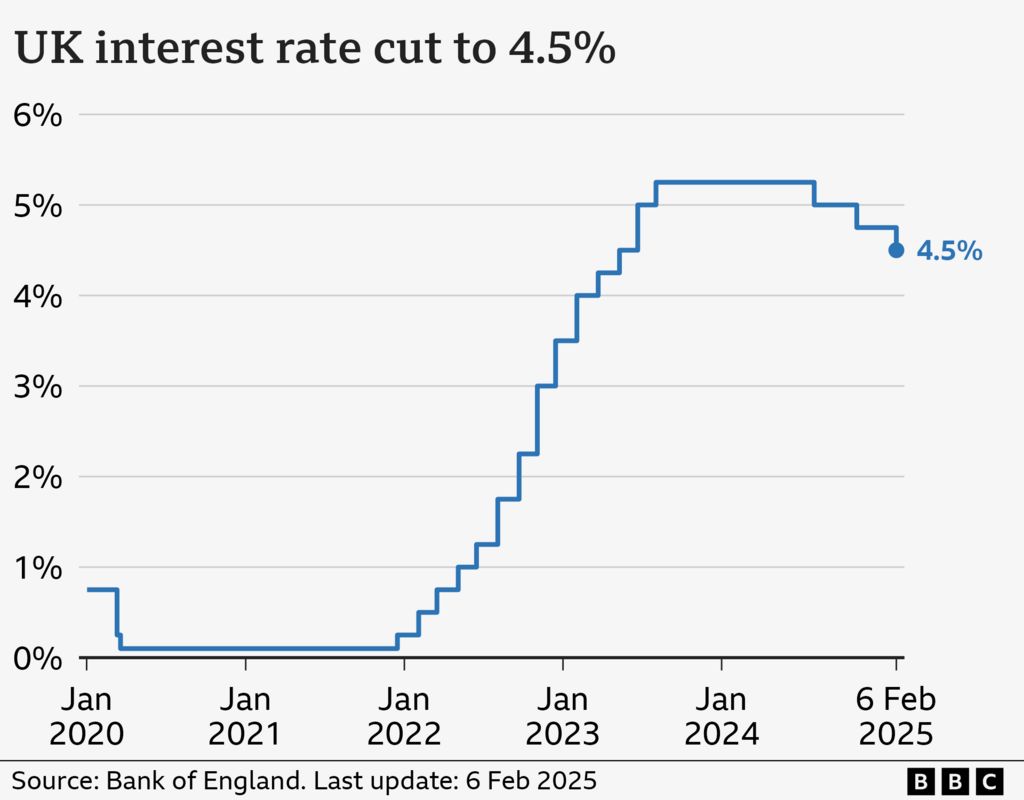

The Bank’s new growth forecast came as it cut interest rates to 4.5% from 4.75% in a move that had been widely expected.

While it cut its forecast for 2025, the Bank increased its prediction for growth in both 2026 and 2027.

The economy is now expected to grow by 1.5% in both of those years, the Bank said, up from 1.25%.

It also predicted that higher energy and water bills would push up inflation “quite sharply” later this year.

Inflation – the rate at which prices rise – is now expected to rise to 3.7% and take until the end of 2027 to fall back to its 2% target.

The Bank said it would take a cautious approach to future interest rate cuts as it weighs up a number of factors that could affect inflation, including threats of trade tariffs from US President Donald Trump.

“We’ll be monitoring the UK economy and global developments very closely and taking a gradual and careful approach to reducing rates further,” said Bank of England governor Andrew Bailey.

“Low and stable inflation is the foundation of a healthy economy and it’s the Bank of England’s job to ensure that.”

Chancellor Rachel Reeves said the interest rate cut was “welcome news”.

“However, I am still not satisfied with the growth rate. Our promise in our Plan for Change is to go further and faster to kickstart economic growth to put more money in working people’s pockets.”

Shadow chancellor Mel Stride said while the rate cut would good news for many families and businesses, he added the government’s “disastrous Budget” was likely to mean fewer rate cuts this year than expected.

Mortgage impact

The rate cut means that for the 629,000 homeowners on mortgage tracker deals that move in line with the base rate, there will typically be a £29 fall in monthly repayments, according to figures from banking trade body UK Finance.

The near 700,000 people on standard variable rate mortgages will have to wait to see if their lender responds.

Those on a fixed mortgage deal will see no immediate change, but there might be cheaper deals for available for new and renewing customers.

However, the rate cut is likely to lead to lower returns for savers.

Nicola Price and her husband John have still got 18 months remaining on their current mortgage deal, and welcome lower interest rates as it means they will pay less interest on their next mortgage – if rates remain low.

Nicola wishes for “certainly no more increases” and thinks the sweet spot for her will be a rate of around 3%.

Her husband John says that falling interest rates are going to be tough for others though.

“Our parents rely heavily on a better interest rate, so we see the flip side for the next generation.”

In its quarterly inflation report, the Bank said economic growth had been “broadly flat since March last year”.

The UK economy showed zero growth between July and September.

For the following three months, the Bank of England now expects it to shrink by 0.1% against a previous forecast for 0.3% growth.

A recession is defined as two consecutive three-month periods of economic contraction.

The Bank now expects the economy to grow by just 0.1% between January and March, down from its 0.3% forecast published last November.

The latest official growth figures for the UK economy will be published next Thursday.

Sign up for our Politics Essential newsletter to read top political analysis, gain insight from across the UK and stay up to speed with the big moments. It’ll be delivered straight to your inbox every weekday.

Adblock test (Why?)